In an increasingly interconnected world, the ripple effects of sudden geopolitical upheavals extend far beyond national borders. Investors, businesses, and policymakers grapple with the aftershocks of conflicts, sanctions, and shifting alliances as markets adjust with remarkable speed.

This comprehensive analysis explores the definition of these shocks, their direct market impacts, and the strategic responses shaping 2025 and beyond.

Geopolitical shocks refer to sudden political or security events—from wars and terrorist attacks to sweeping sanctions and major elections—that can rapidly upend the global economic landscape.

They typically fall into two broad categories:

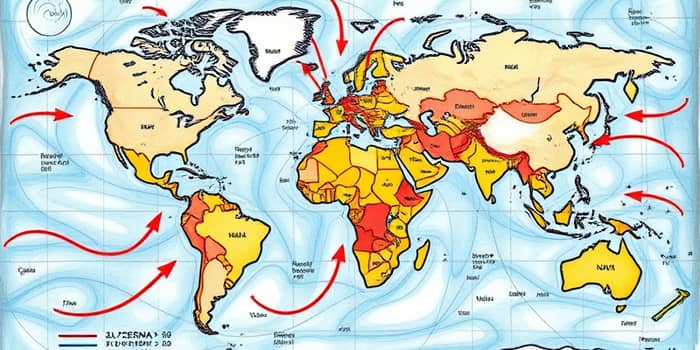

Several regions stand out as epicenters for geopolitical tension, each carrying unique risks and market implications.

When news of a geopolitical shock breaks, markets often react with pronounced volatility. Historical data offers sobering lessons:

• Following the attack on Pearl Harbor, the S&P 500 plunged 3.8% the next day and ultimately fell nearly 20% at its trough.

• On the day President Kennedy was assassinated, the index dropped 2.8%.

Sectoral impacts can vary widely: energy and defense stocks often jump amid heightened tensions, while aerospace and travel sectors face significant downturns. Agricultural commodities may surge as export routes are disrupted, driving further inflationary pressure.

Beyond headline indexes, sector-specific shifts and credit dynamics amplify the impact:

• Global equities typically decline by approximately 1% in the month following a major event, with emerging markets trailing by up to 2.5%.

• Sovereign credit risk premiums can rise by 30 basis points in advanced economies and 45 basis points in emerging markets, in some cases multiplying baseline risk costs fourfold.

These numbers underscore the intensifying market and credit risks that surface in the wake of sudden geopolitical turbulence.

Geopolitical shocks often trigger cascading effects across inflation, growth, currency valuations, and global trade.

Inflation tends to surge as energy and commodity prices spike in response to supply disruptions. Central banks in advanced economies, mindful of elevated price pressures, are expected to maintain interest rates above pre-pandemic lows well into 2025.

Currency markets also evolve amid these headwinds. While the U.S. dollar’s reserve status offers a buffer, potential depreciation looms if growth diverges and interest rate differentials narrow.

Supply chains face another critical juncture. Proposed tariffs—like a 60% levy on Chinese imports and 20% on other trading partners—threaten to fragment long-standing trade flows. At the same time, investment screening and sanctions emerge as powerful geoeconomic tools, redirecting foreign direct investment toward geopolitical allies and safe-haven sectors.

These trends collectively accelerate a broader deglobalization or trade fragmentation process, as nations prioritize strategic autonomy over integration.

Despite shared vulnerabilities, each region exhibits distinct trends and challenges:

These figures reflect the uneven recovery trajectories and varying risk exposures that global stakeholders must navigate.

As geopolitical shocks become more frequent and complex, organizations must bolster their defenses and adaptability.

Adopting these measures empowers institutions to maintain stability during sudden shocks and to capitalize on the market dislocations that often follow major events.

Risk surveys highlight state-based conflict as the top global threat for material crises in 2025, cited by 23% of experts, with geoeconomic confrontation closely behind. Compounding these geopolitical dangers, extreme weather events pose additional strain on already fragile supply networks.

In this evolving landscape, resilience and adaptability—not just cost efficiency—stand out as the pillars of sustainable growth. Companies and governments must embrace dynamic scenario planning, deepen investments in technology and cybersecurity, and nurture robust international partnerships.

Looking ahead, technological advancements such as AI-driven risk analytics and blockchain-enabled supply tracking will play an increasingly vital role in decoding complex geopolitical signals and automating adaptive responses.

While fragmentation and frequent market shocks appear likely to persist, stakeholders equipped with foresight and flexibility can turn geopolitical challenges into opportunities for innovation and strategic realignment.

Ultimately, the echoes of geopolitical upheavals will continue to reshape markets. But with informed strategies and unwavering resilience, investors and institutions can chart a course toward stability and growth—even amid uncertainty.

References